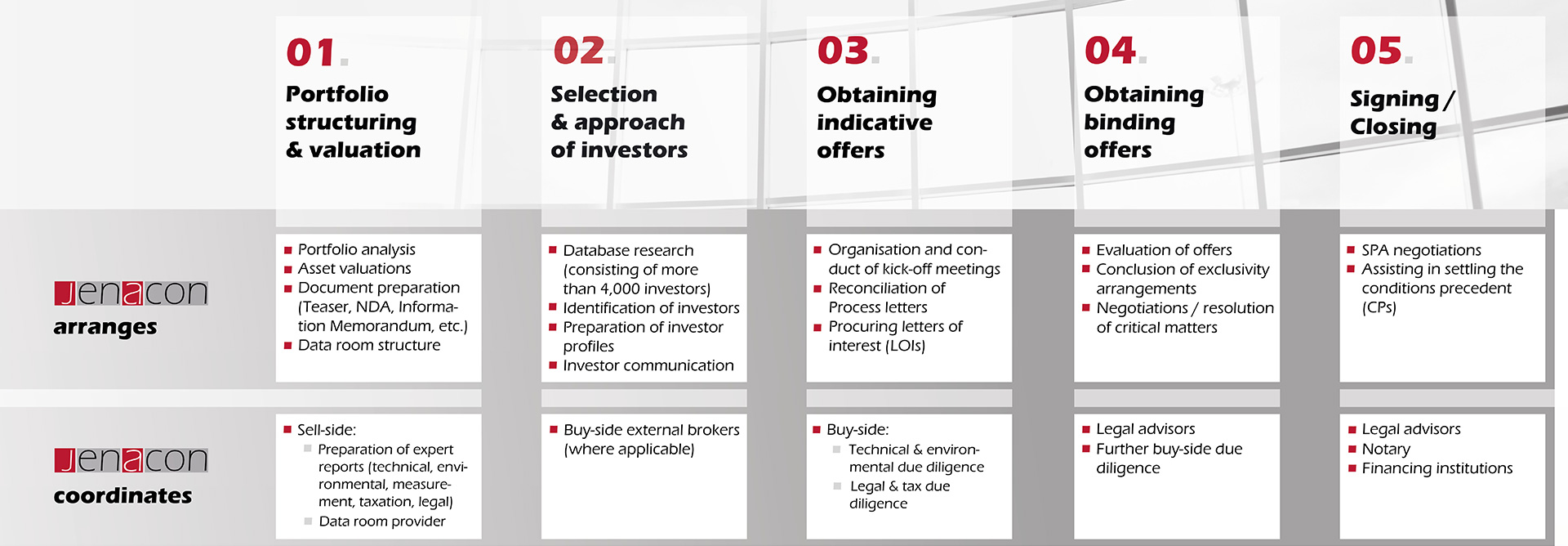

JenAcon coordinates the entire transaction process from property selection to closing

We accompany all phases of the transaction process with a consultative approach - from property selection and structured marketing to closing and the processing of the conditions precedent. The client’s concerns are always our priority: are acquisitions planned, or will the portfolio be adjusted by sales? Asset or share deal? Should existing properties or project developments be (re-)financed, e.g. classically via debt capital, equity, mezzanine capital, or by a sale-and-leaseback? Whether single assets or portfolios, we focus on volumes compatible with capital markets. In addition to retail properties, we have already successfully sold real estate from all asset classes such as office, hotel, residential, healthcare, parking, light industrial, logistics, special properties (police stations, pharmaceutical parks, etc.), mixed-use or real estate with an NPL background.